Marginal costs

Marginal costs in the economy are those generated by the production of an additional product unit, while in accounting they correspond to the average variable costs. By distinguishing between variable and fixed marginal costs, we can easily calculate whether to accept a special order or to discard the product. Let’s see it on the case of profitability of production under the private label.

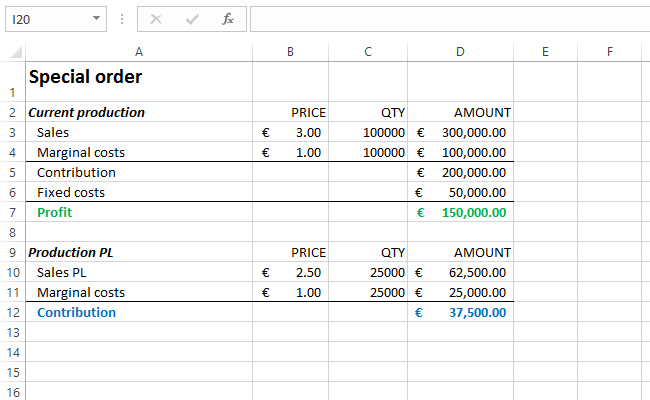

Deciding on marginal costs implies that fixed costs remain unchanged. In the following example, we will analyze the work of a dairy factory that, among other, produces cheeses. By employing 80% of its capacity, this factory sells 100,000 packages (pieces) of cheese at a price of € 3 per pack. The total cost is 150000 €, while the fixed cost is 50000 €. The retail chain has offered the producer to use the rest of its capacity to produce cheese under his private label, provided that the selling price is 2.5 €. Does this producer pay off?

Marginal costs will be calculated as the difference between total and fixed costs (150000 € – 50000 € = 100000 €), and when this amount is divided with a quantity of 100000 pieces, we arrive at a cost of 1 € per unit of product. If we deduct from total sales the total costs, we will reach the profit that the company generates on the sale of cheese, which in this case is 150000 €.

By using the remaining capacity, the manufacturer can produce an additional 75,000 pieces, which we come up with using the following formula that we enter into cell C10:

=(D3/80)*20

When we multiply this amount with a price of 2.5 € we reach the total of 62.500 €. Since the fixed costs do not change, this total should only be deducted by the marginal costs, the value of which is 25000 €, and we will come to the contribution of 37500 €. So, by employing remaining capacity we should achieve additional profit in the stated amount.