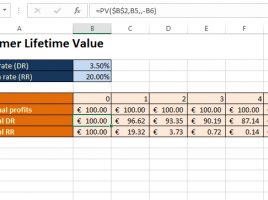

Finance tables

How much will our money be worth in the future? Calculating the future and present value of the cash flow is a complex mathematical process. Today it’s easy, because Excel has a class of functions that only deal with this area. Sometimes, in order to facilitate the assessment of the justification of the investment, the so-called “Financial tables” containing discount rates were used to calculate values for the given interest rates and time periods.