Should we keep the product?

In economics, the question often arises: Do you leave or keep a product? The answer to this dilemma is often difficult to find, but by analyzing the summary of the income statement we can come up with quantitative data that can make it easier for us to make such a decision. This is also an appropriate way to apply a Scenario method by which we can calculate alternatives depending on the steps taken.

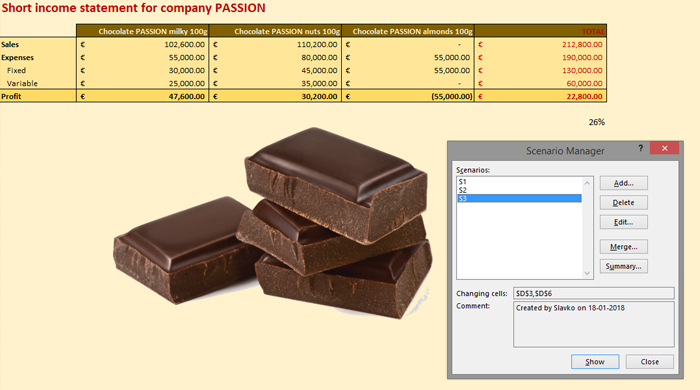

In our simple case, the company “PASSION” produces three types of chocolate: milk, with hazelnuts and almonds. The best sold is chocolate with hazelnuts, and the biggest profit comes from milk chocolate. Management would like to find out: how much profit will be reduced if the production of one of these three chocolates is abolished? The abolition of production implies the disappearance of sales revenues and variable costs, while fixed costs remain.

Let’s make three scenarios. Select the Data ribbon, the What-If Analysis menu, and then the Scenario Manager option. Window with the same name will open, and by clicking Add, we start the creation of the first scenario. In the window that opens we will enter the name of the scenario (S1), a short description and we will mark that this scenario changes the cells where the revenues and variable costs of the first product are indicated. In the next step we will indicate that the scenario assigns a value of 0 to these cells. In a similar way, we will also create scenarios S2 and S3 simulating the cessation of production of the second and third products.

For easier analysis, we will add another formula below the table in which the total profit is divided by the value of € 88,000, which is the amount of current total profit. Let’s start Scenario 1 first, then Scenario 2, and finally Scenario 3 (after launching each one we need to click on UNDO to return to the original values). This could have been done more elegantly by creating a „zero scenario“ that returns the initial values in the table, but this time this is skipped.

What are the results? By eliminating the first product, the profit falls to 13% of the initial profit, by abolishing the second it drops to 15%, and abolishing the third it becomes 26%. According to the logic, it is most worthwhile to cancel the third product, but maybe the best solution for the time being is to keep all three products and try to reduce costs. It is noticeable that the third product has more fixed costs value compared to the other two, it should be re-examined and see if there may be some savings here.